This week is not going to be a typical trading journal post, but more of a progress update.

After figuring out the basics and getting everything set-up and in place, experimenting with some live trading, I decided to take a step back and ask myself the question: "What do I really need in order to become successful as a trader?" Interestingly enough, this started by me getting invited to a webinar about journaling trades and how that can help improve my trading. The webinar was average, not really anything I wasn't aware of yet, but someone blurted out a book recommendation that caught my attention. I looked into that, among some other things I was evaluating this week, and eventually realized it all boils down to 3 key components that are essential for success:

- A profitable strategy.

- The right mindset.

- The right environment.

In fact, this might apply to many aspects of life, but right now I am looking at this specifically from a trading perspective.

A Profitable Strategy

There are many approaches to gaining an edge in the market. One thing I know for sure by now is that it's incredibly difficult to start from scratch, going in blindly, and to figure everything out by myself. I believe it's possible, but either way, I'm fully convinced that this would require a substantial amount of time and a fairly large monetary investment.

There are strategies that are being peddled on the internet, which is not something I am interesting in or have looked into.

Fortunately, my broker Global Prime recently established a new Discord server, where highly skilled, experienced and very successful traders offer to mentor other clients of Global Prime, entirely for free. They share their strategy and knowledge, it's possible to ask questions and get feedback, and there are regular calls where the mentors talk about their strategy, how they implement it, what works for them and what doesn't.

This doesn't mean that it's as simple as copy and paste, but it's so much more of a head start compared to starting completely from scratch all by myself. Although I am fully aware that eventually I will still have to figure out what works for me personally, how to adapt any strategy to my own trading style and then work with that.

If you are reading this for whatever reason, know one thing, and I cannot stress this enough: TRADING IS A SERIOUS JOB AND A FULL-TIME CAREER, NOT A GET RICH QUICK SCHEME. Some people try and take shortcuts, go into chatrooms to receive trading signals, or they copy trade, and so forth. I believe this is part of the reason why the vast majority of people ultimately fail and tend to incur losses. You have to treat this as a serious job, like any other, and accept that it will take time to master it. In my previous career, it took me around a decade of very hard work to get to a point where I achieved mastery and things became essentially effortless.

I just started digging in, this is work in progress.

The Right Mindset

The following part will be quote heavy.

One of my core believes is that if you're really serious about something and are investing your time, money and effort into it, are persistent and won't let yourself get dragged down by misfortune, setbacks, other people or difficult circumstances - then the universe will come to your aid and the things that you really need to become successful will somehow present themselves to you.

That's essentially how I came across an interesting book:

"Trading in the Zone is an in-depth look at the challenges that we face when we take up the challenge of trading. To the novice, the only challenge appears to be to find a way to make money. Once the novice learns that tips, brokers' advice, and other ways to justify buying or selling do not work consistently, he discovers that he either needs to develop a reliable trading strategy or purchase one. After that, trading should be easy, right? All you have to do is follow the rules, and the money will fall into your lap.

At this point, if not before, novices discover that trading can turn into one of the most frustrating experiences they will ever face.

This experience leads to the oft-stated statistic that 95 percent of futures traders lose all of their money within the first year of trading. Stock traders generally experience the same results, which is why pundits always point to the fact that most stock traders fail to outperform a simple buy and hold investment scenario.

So, why do people, the majority of whom are extremely successful in other occupations, fail so miserably as traders? Are successful traders born and not made? Mark Douglas says no. What's necessary, he says, is that the individual acquire the trader's mindset. It sounds easy, but the fact is, this mindset is very foreign when compared with the way our life experiences teach us to think about the world."

This is from the foreword, and it peaked my curiosity. At this point I am about halfway through the book and I can honestly say that it's more than just a technique, or a method you robotically apply, or something else along those lines. It's about more than that. I am now starting to understand how in order to master trading, and to have a chance of becoming one of the few successful people in the field, I first have to master myself.

Also, on a more personal note, this quote from the book really resonated with me, for various reasons...:

"I started trading in 1978. At the time, I was managing a commercial casualty insurance agency in the suburbs of Detroit, Michigan. I had a very successful career and thought I could easily transfer that success into trading. Unfortunately, I found that was not the case.

By 1981, I was thoroughly disgusted with my inability to trade effectively while holding another job, so I moved to Chicago and got a job as a broker with Merrill Lynch at the Chicago Board of Trade. How did I do? Well, within nine months of moving to Chicago, I had lost nearly everything I owned. My losses were the result of both my trading activities and my exorbitant life style, which demanded that I make a lot of money as a trader. From these early experiences as a trader, I learned an enormous amount about myself, and about the role of psychology in trading."

The Right Environment

I have written about some of this before, when I explained why I chose Global Prime as my forex broker. However, there is more to it than that. It's also about the people you surround yourself with, the company you keep, your co-workers and business partners, and especially the friends you have - in other words, your social circle.

There is another interesting quote I came across this week, from a life coach called Corey Wayne:

"Life and living at your personal best is to be found living in the present moment taking action towards becoming all that you are capable of being. The action you take or fail to take today is what will determine what your future becomes. Winners expect to win and take the actions required to eventually manifest their grandest goals and dreams, despite the fact that success lies far off in the future or seems unrealistic to others.

Losers quit and give up on their dreams when the first sign of difficulty or challenges arise, and then they seek to sabotage the dreams of those around them so they can convince them to give up like they have, so they can feel better about their lack of success. Misery loves company.

Your inner circle ideally should consist of people who are just as committed to their own greatness as you are to your own and who celebrate and encourage your victories and continued perseverance."

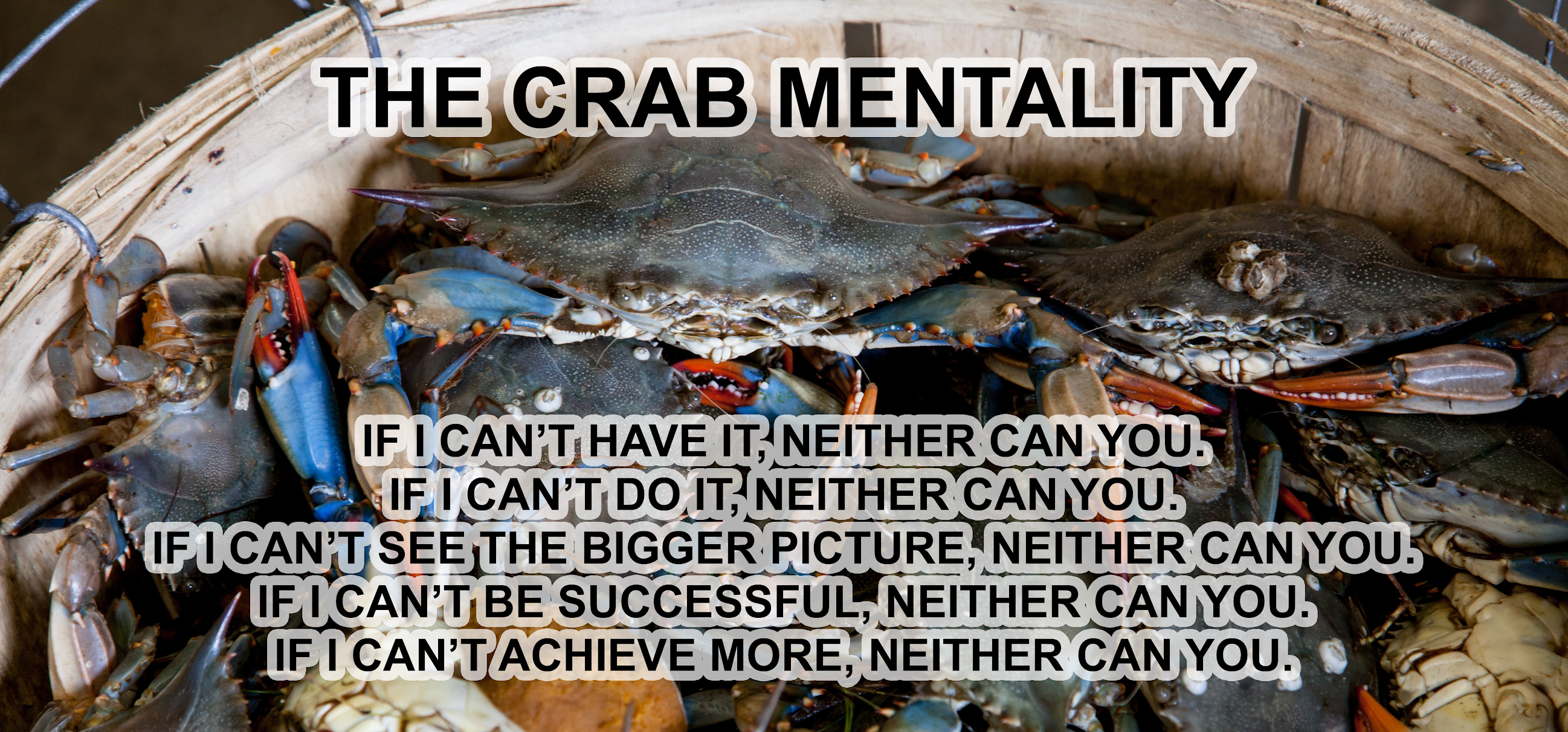

There are many formulations of this principle, a fairly popular one for the negative side of it is crab mentality:

In short, choose your friends wisely and get out of that bucket!

No comments

Post a Comment